ALERT: Changes in New York

https://www.nysba.org/lawyerreferral/

800-342-3661

New York State Unified Court System

http://iapps.courts.state.ny.us/attorney/AttorneySearch

212-428-2800

https://www.nysba.org/lawyerreferral/

800-342-3661

New York State Unified Court System

http://iapps.courts.state.ny.us/attorney/AttorneySearch

212-428-2800

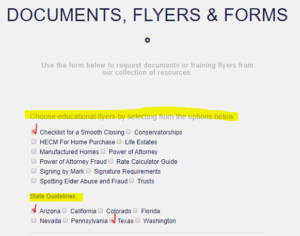

Request copies of the ARS State Guidelines and other educational flyers through the Allegiant Reverse Services website. Follow the steps below to learn how to request state guidelines and other documents from our growing library.

Ins and Out of Title and Settlement in Texas

Join us for a webinar dedicated to walking you through a Texas closing from start to finish, with an emphasis on Texas guidelines. We will review vesting tips and hits, required forms and documents, state specific fees, trusts and so much more.

Click here to register.

Introduction to Powers of Attorney

Wednesday, March 18, 2020 – 10:00am PST/1:00pm EST

Please join us for our upcoming webinar entitled: Introduction to Powers of Attorney (POA). Reverse mortgages are complex and being prepared is key to a successful closing. Powers of Attorney are very common in the Reverse Mortgage industry. We are happy to share our experience and knowledge with you and together we can make the borrower’s experience a pleasant one.

Click here to register.

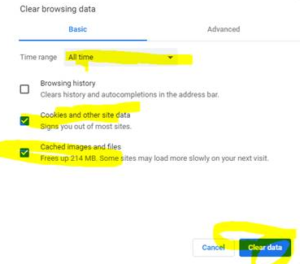

Unknown website errors can be common if you haven’t recently cleared the cache and cookies from your browser. We recommend starting with this action to see if the website issue resolves. Email Solutions@AllegiantReverse.com if the issue persists. Follow the steps below for how to clear cache and cookies from a Google Chrome browser.

![]()

5. When finished, close your browser and try again.

Download the PDF below for future reference.

Due to changes in the California Consumer Privacy Act the age filter is no longer an option when customizing a marketing list in ListSource. Click here to read the Assembly Bill No. 375. Even though these updates cause some difficulty for the user, there are still a number of filters available to help you target your demographic.

NATIC released the following alert on January 28, 2020 advising to be aware of potential fraud and phishing schemes. Read below or download the PDF at the bottom of the post.

NATIC has been advised of a potential fraud and phishing scheme involving attempts to impersonate Patrick L. Henry (Patric or Patrick Henry) who is affiliated with Real Estate Investors Network, which is an owner of multi-family properties in California. The alleged fraud involves targeted emails with an incorrect URL that are allegedly from OS National Title Agency (OSN), and specifically Patrick L. Henry. The correct URL for OSN is osnational.com, while the falsified URL includes an additional letter “s” as follows: osnationals.com.

Should you receive a similar email originating from Patrick L. Henry, Real Estate Investor Network, or OSN, do not open the email. Instead, work with your agency’s technical support team to quarantine this email and increase the protections in place to ward off these threats.

Additionally, please notify your NATIC California underwriting counsel via email, CAunderwriting@natic.com, regarding any such potentially fraudulent activity.

Effective January 3, 2020 the TitleFlex application was updated to comply with the latest TLS internet security protocol. TLS (transport layer security) allows computers to communicate over the internet securely without the transmissions being vulnerable to hackers. There are several know weaknesses in TLS 1.0, the current protocol, and as a results over the last year the computer services industry including most application providers have already moved or prepared for a 2020 move to the improved TLS version 1.2.

How will you be impacted?

If you are using an older, unsupported version of any of the browsers below your TitleFlex application will no longer function beginning January 3rd. TLS 1.2 is not compatible with many older browsers. Depending on the version of browser installed on your system you may need to update to the latest version. If you are already using the supported browser no action is required.

Click here For help understanding how to check your internet browser version and to review the official TitleFlex notice.

Fraud Prevention – CRMP Certified Course

Join us for a class dedicated to enhancing the security of your transaction. We have compiled a comprehensive overview of some of the most common ways you can detect and prevent fraud. Allow us to share with you ways to stay alert to fraud so you can protect yourselves, your clients and increase overall awareness of the dangers of fraud.

Click here to register.

The Payoff Process

Wednesday, February 19, 2020 – 10:00am PST/1:00pm EST

Paying off debt is a crucial part of the reverse mortgage transaction. Join us to familiarize yourself with the timeline and requirements when there is debt involved. We will also cover ways to identify potential liens that may cause delays in the closing of your file.

Click here to register.

With the New Year upon us, multiple law enforcement agencies across the country are advising consumers, legal and financial professionals to take care to write out the entire year, 2020, when dating and signing documents. Using the shorter abbreviation will allow fraudsters to alter documents by adding numerals after the 20, thus altering the date and legal impact of those documents. For example, 01/03/20 could easily be altered to read 01/03/2019. In some cases, this alteration may render the document void.

See the document below from NATIC to share this message with colleagues and loved ones.

The Department of Financial Services (DFS) gave a formal press release that was distributed on January 4, 2020 outlining the heightened risk of cyber attacks from hackers affiliated with the Iranian government. There is a history with Iran launching cyber attacks against the U.S. and the financial services industry. DFS is urging all regulated entities to increase their vigilance against cyber attacks. Although there have been no noted attempts made, it is important to remain prepared to quickly respond if an event were to occur. They advised that Iranian-sponsored hackers typically resort to common hacking tactics such as email phishing, credential stuffing, password spraying and targeting unpatched devices. DFS asks that you notify them promptly of any significant or noteworthy cyber attacks.

Any questions or comments regarding this alert should be directed to CyberAlert@dfs.ny.gov.

Click the link below to read the full press release.

Instead of Title Tales this month, how about Title Tips? Specifically, Title Tips for Trusts (say that ten times fast and see where your tongue ends up!). ARS specializes in reverse mortgages, and for obvious reasons there are many more trusts to review in proportion to orders than for any other loan type. They keep […]

Written by: Mylene Marcelo, Title Manager/Title Officer We have a current vesting deed adding son into title dated 2017 as joint tenants with rights of survivorship. The Deed was executed by a Power of Attorney (POA) made by Wilma, Principal to Fred Jr., as Agent. The POA was dated 1997. Wilma was competent at the time […]

A division of

Proud members of

Trusted and Verified by